texts from 6245

Why Am I Getting a Text From Wells Fargo?

Benjamin Gardner didn't know virtually Wells Fargo scam texts — until information technology was besides late. When the Navy veteran received a message about a fraudulent charge on his business relationship, he panicked and replied immediately [*].

Moments subsequently, his phone rang with "Wells Fargo" displayed on the caller ID. The caller explained that Benjamin'southward account had been compromised, and the only way to protect his money was to transfer it to some other account via Zelle. Only instead of keeping his money safe, Benjamin sent $3,500 of his savings directly to a scammer.

There were 87.8 billion scam texts sent in 2021 alone [*]. But while the types of scam texts may vary, the perpetrators are almost always after ane thing: your money.

Wells Fargo and its associated coin transfer app, Zelle, are common targets for text scammers. Fraudsters pose equally banking concern representatives or send fake fraud alerts to trick you lot into giving up money or admission to your accounts — with no mode of getting dorsum your stolen funds.

In this guide, nosotros'll cover Wells Fargo scam texts, how to spot them, and proactive steps that you tin can take to stay prophylactic.

What Is the Wells Fargo Text Scam? How Does It Piece of work?

A Wells Fargo scam text is a type of smishing assault in which con artists transport text messages that merits to be from a bank — typically disguised as phony fraud alerts.

The goal is to make people believe their accounts are at risk so that they will make it affect and, ultimately, either betrayal personal information or unwittingly ship money to the scammer.

Since 2021, reports of SMS scams have grown, every bit scammers target customers of Wells Fargo banking company — and other financial institutions, including Citi and Bank of America [*].

Hither's how the scam typically plays out:

- Scammers ship text letters claiming to be from Wells Fargo. Similar phishing emails, the fraudsters effort to make the communications look authentic, even spoofing the phone number to look like the phone call is coming from Wells Fargo.

- The message often includes a fraud alert, notifying you that there has supposedly been a accuse or other suspicious action on your Wells Fargo account.

- To secure your account or refund the charge, the message insists that you reply, call a phone number, or click on a link.

- If you click on the link, it volition direct you to a artificial website, which will try to steal your personally identifiable data (PII) — such as your bank account information, login credentials, or Social Security number (SSN).

- If you answer to the text message or telephone call the number, y'all'll be contacted by someone challenge to be from the "Wells Fargo Fraud department." The scammer may spoof your caller ID to make the call seem more convincing.

- The impersonator volition offer a solution to reverse the charges, or propose you to update your account information. Yous may be encouraged to remove the telephone number from your Zelle account and send coin to yourself.

- However, this process enables the scammer to take over your Zelle account, and so any transfer that you make "to yourself" volition actually become straight to the scammer.

How To Tell If a Wells Fargo Text Is Legitimate or a Scam

Professional con artists can be extremely disarming, especially when victims think their money is at risk. It'southward important to remain at-home and take a moment to think carefully earlier following the advice offered in an unsolicited text message or phone telephone call.

Hither are the chief warning signs of a Wells Fargo scam text:

The text creates a sense of urgency

Scammers ofttimes claim that your Wells Fargo business relationship is at risk or that you'll lose money if you don't take activeness immediately.

In 1 example, Lisa Landry received a fraud alarm text when she was using Zelle to sell novelties at the Cal Expo Winter Wonderland. A "Wells Fargo rep" so called her and urged her to deed fast to save her coin. Inside minutes, Lisa sent $iii,000 earlier realizing the truth — while the scammer taunted her on the phone [*].

Remember: No bank official will pressure or rush you into making transactions or transferring your money out of your account.

The text scammer uses vague or publicly available information to build trust

Some scammers find data about you on social media sites or the Night Web and mention partial card numbers to make you lot retrieve they are legitimate. For instance, they will say in that location has been activeness on a carte du jour starting with "4342" to brand y'all think it's your bill of fare.

Yet, it'due south worth remembering that all Wells Fargo debit cards first with these same four numbers!

The text includes a suspicious link

Links in spam letters may lead to malicious websites where scammers tin can steal your data or upload malware to your calculator. If yous wait carefully, you lot tin oft spot these artificial links because they include lots of random letters and numbers.

Regardless of how convincing the communication may seem, you should always avoid clicking on links in text messages. If you want to check the authenticity of a claim, it'due south all-time to become directly to the bank's official website or app.

There are spelling, grammar, and formatting mistakes

Typos are major red flags indicating a Wells Fargo scam text. Banks are unlikely to make such footling mistakes in their communications, whereas many scammers originate in countries in which English is not the native linguistic communication.

Look carefully at the text message's spelling, grammar, and design to run across if there is annihilation suspicious. Some scammers brand their links more than disarming past using subtle variations of the bonafide URL address — for example, "weilsfargo.com," or "wellsfarrgo.com."

💡 Related: I Replied To a Spam Text! What Should I Do Now? →

Information technology'southward from an unknown sender

Banks employ specific "brusque codes" when sending text letters. In the case of Wells Fargo, whatsoever legitimate text should use one of these five-digit curt codes [*]:

- 935-57

- 937-33

- 937-29

- 546-87

If you receive letters from another number, there's a risk it could exist a Wells Fargo text scam. Before you take action or respond, ask yourself: practise you recognize the sender or phone number?

Y'all receive an unexpected phone call

A primal aspect of smishing scams is spoofing the victim's caller ID — making it seem similar the call is coming from an official institution, similar the IRS, FBI, or your depository financial institution. However, y'all won't receive text messages from Wells Fargo unless you lot specifically consent to the bank contacting yous this manner.

If anyone calls claiming to be from Wells Fargo and asks for sensitive information similar your PIN or online cyberbanking password, this is a clear red flag of a scam.

There'south a request for you lot to delete your Zelle number

It's easy for thieves to take over your Zelle business relationship if they have your name and phone number — they only need y'all to remove your phone number or delete your current Zelle business relationship start.

If you're on the telephone with someone claiming to exist from Wells Fargo and are asked to delete your Zelle account, don't do it. Scammers volition take over your account and and then tell you to send coin "to yourself" — merely the money will actually go to them.

💡 Related: Zelle Scams and How Thieves Are Siphoning Abroad Your Money →

The 7 Latest Wells Fargo Scam Texts To Watch Out For

- Fake transaction warnings

- Your Wells Fargo account is blocked

- Fraudulent new login alert on your business relationship

- There's been unusual activeness on your card

- Update your account information

- Verification is required for your account

- Attempted Zelle transfer

Scammers are constantly adapting and evolving their scams to try and trick you. Here are tips to assist you spot 7 of the latest Wells Fargo scam texts:

1. Fake transaction warnings

The about common blazon of Wells Fargo text scam occurs when you lot receive a text message about a recent transaction that supposedly happened on your debit or credit carte du jour.

Scammers include the "4342" number to flim-flam people into believing it actually is their menu. The aim is to brand you panic and answer to the text, at which point the scammer will phone call you.

On the phone, they tin pressure you into sharing personal information and coerce y'all to brand transactions to "opposite the charges" on your account. However, whatsoever money you transport will end up in the hands of the scammers.

How to identify a fake Wells Fargo transaction alert text:

- The text but includes the get-go 4 digits of your carte.

- The bulletin will be from an unknown number — not from 1 of Wells Fargo's verified shortcodes.

- If you check your online banking or Wells Fargo app, there will be no sign of the alleged transaction.

💡 Related: Wells Fargo Identity Theft Protection: Pros, Cons, and Alternatives →

2. Your Wells Fargo business relationship is blocked

Text scams almost always try to create a sense of urgency — and what could be more urgent than making sure your bank account hasn't been blocked?

In this scam, fraudsters ship text messages claiming your business relationship has been locked, and they provide a phone number to call. Their goal is to get you to respond — fifty-fifty if it'southward just to tell them that they have the wrong number. But once they have you on the phone, they tin can go along to target you with their scams.

How to identify a fake Wells Fargo business relationship blocked text:

- Beware of unsolicited contact from Wells Fargo — even if you don't take an account.

- The text contains a vague, unclear message that stirs up curiosity (and may elicit a answer).

- The text includes odd formatting that doesn't seem professional enough to be from a banking concern.

three. Fraudulent new login alert on your account

This Wells Fargo scam text informs you most a login attempt from an unrecognized device. The message will encourage you to click on a link to "protect your account."

Yet, this link will likely straight you lot to a phishing website where scammers can steal your PII. Alternatively, the link may infect your device with spyware that can browse for sensitive data similar login credentials, credit card numbers, and electronic mail passwords.

How to identify a Wells Fargo text scam about a fraudulent login warning:

- You receive a random message that doesn't seem like it's from a genuine banking concern.

- The text contains a suspicious link that doesn't have y'all to the official "WellsFargo.com" website.

- At that place's a lack of relevant or personal information to confirm the message relates to your account.

💡 Related: How To Know If Your Phone Is Hacked →

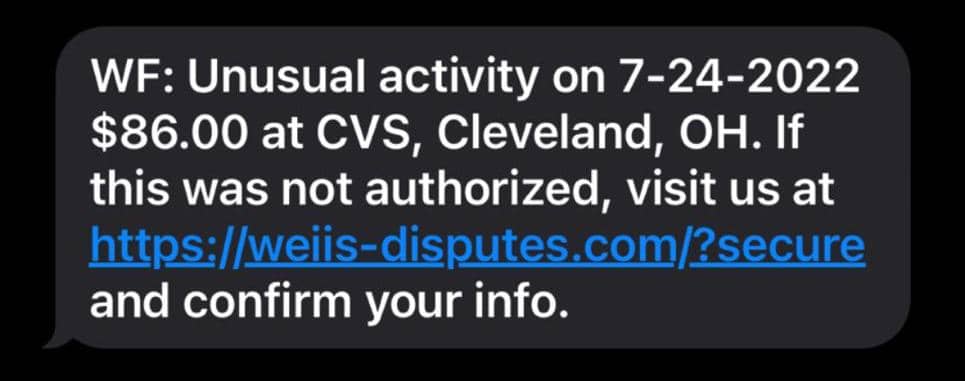

4. There's been unusual activity on your carte du jour

Another variation of the Wells Fargo text scam is a bulletin that mentions "unusual activeness" on your business relationship. Similar the simulated transaction text, receiving this notification may prompt a knee-wiggle reaction that plays correct into the scammer's hands.

Mary Powell received a text bulletin that convinced her somebody had used her account for an unauthorized Amazon buy. After she called, the fraudster proceeded to con the New Bailiwick of jersey woman out of $3,500 under the pretense that he was a Wells Fargo representative who could assist Mary get a refund [*].

How to identify a Wells Fargo scam text about unusual business relationship activity:

- The message comes from an unfamiliar number that isn't ane of Wells Fargo'due south approved shortcodes.

- You're encouraged to click on a link to resolve the problem or confirm details.

- The link URL is hidden, shortened, or uses an wrong variation of the "Wells Fargo" proper name.

💡 Related: How To Protect Your Bank Account From Identity Theft →

5. Update your account data

Rather than mentioning whatever transactions, this type of text scam informs you that Wells Fargo received a request for a password reset on your account. This subtle scam may play tricks you lot into believing that the text is a genuine warning from your bank about an attempted hack.

But in reality, information technology's a double-bluff — equally the scammer is the one sending the warning. If y'all follow the link, y'all'll expose your personal data to the thief.

How to identify a Wells Fargo scam text that contains a password reset request:

- The sender address may reflect an overseas number with an area code.

- The text includes a link to reset your password instead of advising you lot to reset it through the app.

- The link consists of a random sequence of messages and numbers.

Pro tip: Ever log in to your online bank account through an official app or website, not through links in emails or text messages.

vi. Verification is required for your account

Another way that scammers acquit out smishing scams is by sending vague messages that imply the bank needs information to verify your account.

A thief doesn't need whatever personal information about you to ship these texts — not even your name or location. Every bit a event, scammers can play the numbers game by sending hundreds of messages, hoping someone takes the bait.

How to place a Wells Fargo text scam about a required verification:

- The text includes poor spelling or grammar — such as an incorrect title case for Wells Fargo (i.e., "wells Fargo").

- No specific information confirms that the text relates to your account.

- The link may have an unusual URL ending, such as ".xyz" or ".io" rather than the official "WellsFargo.com" domain.

7. Attempted Zelle transfer

1 of the near common types of Wells Fargo text scams begins with a message that asks if you lot approved a Zelle transaction. When you reply — regardless of whether you lot say yes or no — the scammer then calls you.

Later on Cynthia Marin received a text like this, she ended upwards on a phone call with someone whom she believed was from Wells Fargo [*].

The impersonator convinced the California adult female to open Zelle, enter her name, go out the phone number blank, and and so make ii transactions for $1,700. A few minutes later, Cynthia's account rest was at $half-dozen. The scammers had taken the balance.

How to identify a Wells Fargo text scam that starts with an attempted Zelle transfer:

- You receive an warning about an unfamiliar Zelle transaction.

- A message claims to be from "Wells Fargo Fraud Protection."

- The person on the call encourages y'all to transport money "to yourself" on Zelle.

💡 Related: Scammed on Zelle? Hither'southward How To Get Your Money Back →

Did You Answer To a Wells Fargo Scam Text? Practise This!

The good news is that scammers can't practise much if you don't click on a link or telephone call the number provided. Simply what if you do make the fault of taking the bait?

Here are iv possible means in which you could respond to Wells Fargo scam texts — and what you should do to protect yourself in each scenario:

If yous clicked on a link in a fake text bulletin:

- Don't share any personal information like your SSN or credit card details.

- Close the webpage immediately.

- Run a malware scan to check for suspicious activity or newly installed software that you don't recognize. Aura'southward all-in-one digital security solution includes powerful antivirus software that can protect you against viruses and spyware.

If you entered your Wells Fargo account information on a phishing site:

- Cake your debit or credit bill of fare immediately past using the official Wells Fargo app or website.

- Apply another device with virtual private network (VPN) protection to securely transfer all your money to another account — ideally, an account held by a trusted private, like your spouse or parent.

- Telephone call the Wells Fargo fraud squad immediately at 1-866-867-5568.

- Run a malware scan on your devices to observe and remove any suspicious programs.

If you gave scammers your personal information:

- Cancel your bank accounts and credit cards immediately.

- Modify your passwords, particularly those continued to sensitive accounts such every bit your online banking, email inbox, and IRS tax accounts.

- File a fraud report at reportfraud.ftc.gov. The Federal Trade Commission (FTC) tin can help you recover from the fraud.

If you think your device has been infected or if you gave scammers remote access:

- Disconnect your device from the net, Wi-Fi, or mobile data.

- Log out of everything immediately and change your passwords.

- Run a malware scan on the device, and remember to scan any external hard drives.

- Report the scam to the FTC to get their guidance as well as aid authorities stop others from falling prey to the fraud.

- Report the issue to the FBI via their Net Crime Complaint Center.

How To Protect Yourself From Wells Fargo Scam Texts

Spam texts take more than doubled since 2019, with 85% of Americans receiving a robotext in the previous 12 months, according to Truecaller'south U.S. Spam & Scam Report [*].

Sooner or subsequently, you're jump to encounter a Wells Fargo text scam. When the time comes, hither is a list of means that you can protect yourself:

- Ignore and delete suspicious text messages. If you reply, you let the scammers know that your number is active so that they can target you with future scams. They may even add together your phone number to a list that hackers tin buy on the Dark Web.

- Never click on links in texts. Phishing scams take been tricking victims into clicking on links for years via emails and texts. Information technology'due south never a good idea to follow the links in whatsoever text bulletin. Instead, if you want to cheque on your Wells Fargo account, log in directly at world wide web.wellsfargo.com.

- Report spam texts to Wells Fargo. You lot can let the bank know by sending an email to reportphish@wellsfargo.com and by forwarding the scam message to 7726. This method works for any U.S. mobile carrier, including AT&T, T-Mobile, and Verizon Wireless.

- Remove your phone number from data broker lists. It'due south important to minimize the number of subscriptions and mailing lists with which you share your information. Aura can reduce your risk exposure past automatically scanning databases for your information and lodging removal requests on your behalf.

- Filter text messages from unknown senders. By setting up filters, you can prevent spam messages from arriving in your inbox — making you less probable to be taken in by fraudsters.

- E'er confirm the recipient's phone number or email accost earlier sending coin on Zelle. Treat Zelle transfers like cash. If you transport them to the incorrect person, they're essentially gone.

- Sign up for a comprehensive online security provider. Aura offers protection against financial fraud and common scams with a suite of piece of cake-to-use digital security features, including a built-in VPN with war machine-grade encryption to protect your devices. Try Aura free for xiv days to meet if it's correct for you!

💡 Related: How To Stop Spam Texts (on Android and iPhone) →

The Bottom Line: Don't Get Scammed past Suspicious Texts

Remember that Wells Fargo will only text you from their official phone shortcodes, and only if you've opted in to receive text communications [*]. If y'all receive a text from any other number that claims to be Wells Fargo, it'southward a scam.

Unfortunately, text message scams aren't going anywhere; and fraudsters will go along to launch increasingly sophisticated scams in the time to come. If you lot go a victim of a Zelle scam, it might be impossible to go your money back.

An all-in-ane digital security solution is the best way to protect your finances and personal information.

Aura keeps your whole family safe with proactive tools to help place spam, safeguard your devices against malware, and shield against phishing attempts, identity theft, and financial fraud.

Shop, browse, and bank online — safely. Try Aura free for xiv days →

Source: https://www.aura.com/learn/wells-fargo-scam-texts

0 Response to "texts from 6245"

Post a Comment